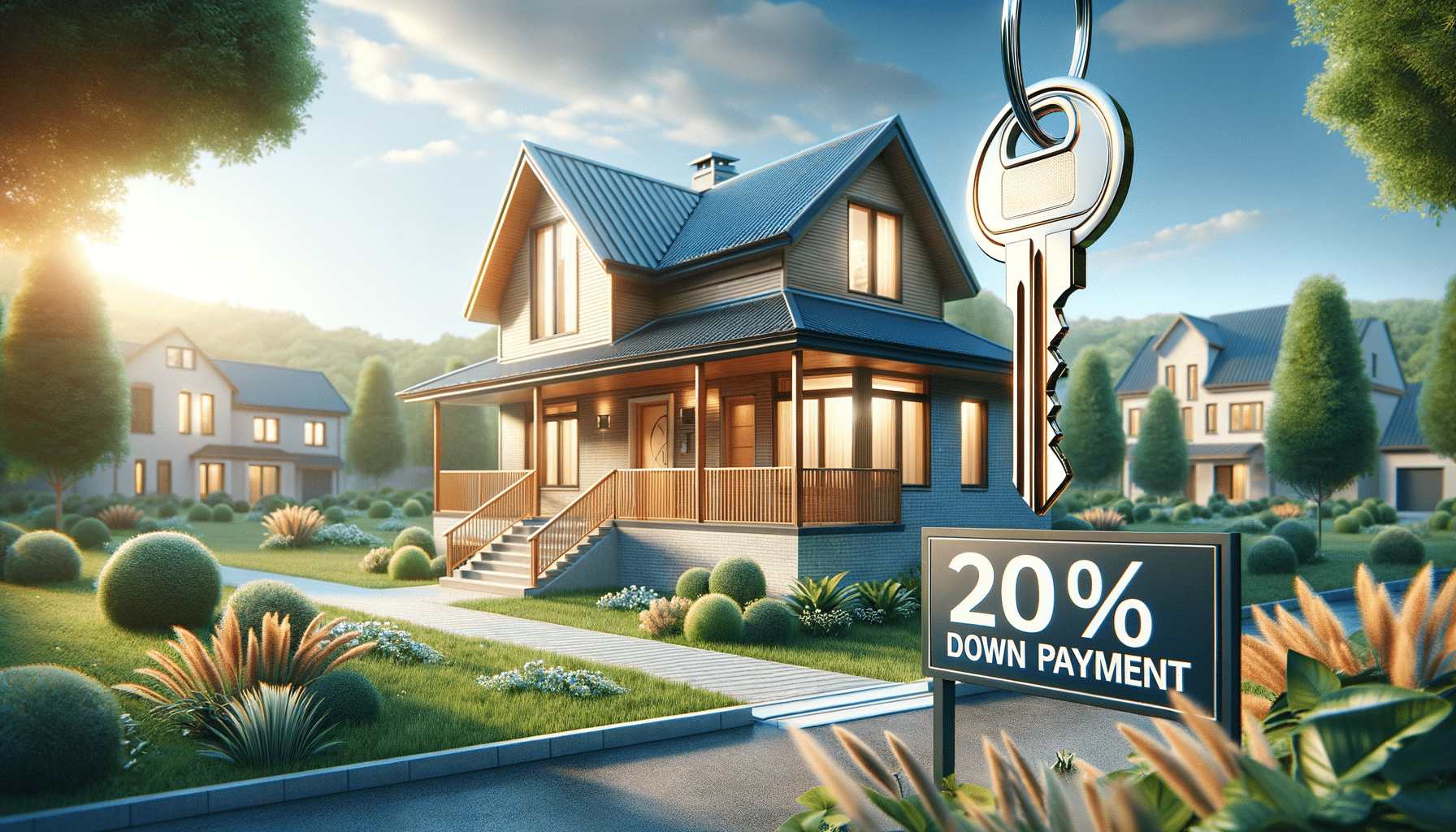

Homeownership Without a Down Payment — It’s Possible

Understanding Zero Down Payment Home Buying

In the journey to homeownership, one of the most significant hurdles is often the down payment. Traditionally, buyers are expected to pay a percentage of the home’s price upfront. However, for many potential homeowners, this is a challenging barrier. Zero down payment home buying programs have emerged as a viable solution, allowing individuals to purchase homes without the immediate financial burden of a large upfront cost.

Zero down payment options are primarily available through government-backed loans. These programs are designed to make homeownership accessible to a broader audience, particularly those who might not have substantial savings. By removing the requirement for a down payment, these initiatives aim to support first-time buyers and those with limited financial resources.

While these programs offer exciting opportunities, it’s crucial to understand the eligibility criteria and implications. Typically, zero down payment loans are available to specific groups, such as veterans or those purchasing in rural areas. It’s essential to research and determine which programs you may qualify for, ensuring that you can take advantage of this opportunity if it suits your circumstances.

Benefits and Considerations of Zero Down Payment Options

Zero down payment home buying offers several advantages, making it an appealing option for many potential homeowners. Firstly, it allows individuals to enter the housing market without the need to save for years. This can be particularly beneficial in areas where property prices are rising rapidly, allowing buyers to secure a home before prices increase further.

Additionally, these programs often come with competitive interest rates, making them financially attractive. By eliminating the need for a down payment, buyers can allocate their savings towards other expenses, such as moving costs or home improvements.

However, there are considerations to keep in mind. Without a down payment, buyers may face higher monthly mortgage payments. It’s essential to evaluate your budget and ensure that you can comfortably manage these payments over the long term. Furthermore, some zero down payment loans may come with additional fees or insurance requirements, so it’s vital to review the terms and conditions thoroughly.

- Immediate entry into the housing market

- Competitive interest rates

- Potential for higher monthly mortgage payments

- Possible additional fees or insurance requirements

Exploring Available Programs and Eligibility

Several programs offer zero down payment options, each with its own set of eligibility criteria. The U.S. Department of Veterans Affairs (VA) offers loans to veterans, active-duty service members, and certain members of the National Guard and Reserves. These loans are renowned for their favorable terms, including no down payment and no private mortgage insurance requirements.

Another option is the U.S. Department of Agriculture (USDA) loan program, which targets rural homebuyers. This program is designed to promote homeownership in less densely populated areas and offers zero down payment options to eligible buyers.

For those not eligible for government-backed loans, some private lenders offer zero down payment mortgages. These typically require excellent credit and a stable income, and they may involve higher interest rates or additional fees. It’s crucial to compare different options and consult with financial advisors to find the program that best fits your needs.

- VA loans for veterans and active-duty service members

- USDA loans for rural homebuyers

- Private lender options with specific requirements