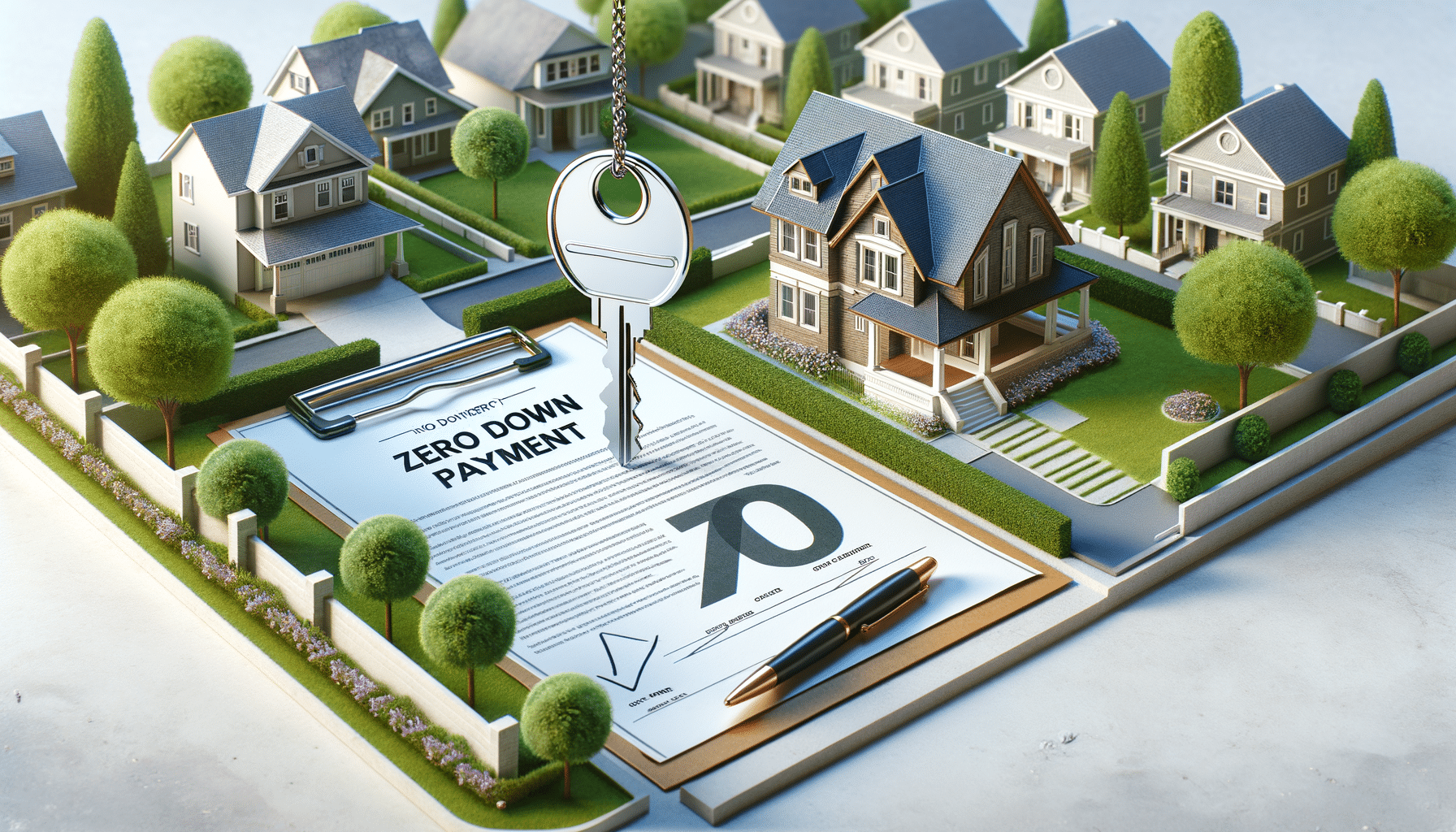

Introduction to Zero Down Payment Home Buying

Understanding Zero Down Payment Home Buying

Zero down payment home buying is an intriguing option for many prospective homeowners who are deterred by the high upfront costs typically associated with purchasing a home. This approach allows buyers to acquire a property without the need to put down a large initial payment, which can often be a significant barrier to entry in the housing market. Various programs and loan options are available that cater to this need, making homeownership more accessible to a broader audience.

In essence, zero down payment means that the buyer is not required to pay a lump sum upfront when closing on a home. This can be particularly beneficial for first-time homebuyers or those with limited savings. However, it’s important to understand that while the initial cost is minimized, other financial responsibilities and commitments remain, such as monthly mortgage payments and potential mortgage insurance.

There are several types of loans that offer zero down payment options. These include government-backed loans such as those provided by the Department of Veterans Affairs (VA) and the United States Department of Agriculture (USDA). Each of these programs has specific eligibility criteria, often based on factors like military service or the location of the property. Additionally, some lenders offer their own zero down payment programs, although these may come with higher interest rates or other stipulations.

Advantages and Considerations of Zero Down Payment Options

One of the primary advantages of zero down payment home buying is the ability to enter the housing market without needing a significant amount of savings. This can be a game-changer for individuals who have steady income but have not been able to accumulate a large savings due to other financial commitments. By eliminating the need for a down payment, buyers can redirect their funds towards other expenses associated with moving and settling into a new home.

However, potential buyers should be aware of the considerations involved with zero down payment plans. Without a down payment, the overall loan amount will be higher, which can result in larger monthly payments. Additionally, some zero down payment loans may require mortgage insurance, which can add to the monthly costs. It’s important for buyers to carefully evaluate their financial situation and ensure they can comfortably manage the ongoing expenses.

Moreover, while zero down payment options make homeownership more accessible, they may not be suitable for everyone. Buyers should consider their long-term financial goals and stability. Consulting with a financial advisor or mortgage specialist can provide valuable insights and help determine the best course of action based on individual circumstances.

Exploring Available Programs and Eligibility Criteria

Several programs are available for those interested in zero down payment home buying, each with its own set of eligibility criteria. The VA loan program, for example, is designed for veterans, active-duty service members, and certain members of the National Guard and Reserves. This program offers competitive interest rates and does not require private mortgage insurance, making it an attractive option for eligible individuals.

The USDA loan program is another viable option, aimed at promoting homeownership in rural and suburban areas. To qualify, buyers must meet specific income requirements and the property must be located in an eligible rural area as defined by the USDA. These loans often come with favorable terms, including the possibility of financing closing costs and repairs.

In addition to government-backed loans, various lenders offer proprietary zero down payment programs. These can vary widely in terms of eligibility requirements, interest rates, and other conditions. It is crucial for prospective buyers to research and compare different options to find a program that aligns with their needs and financial situation.

Overall, zero down payment home buying can be a viable path to homeownership for those who meet the eligibility requirements and are prepared for the financial responsibilities involved. By exploring the available programs and understanding the implications, buyers can make informed decisions and potentially achieve their dream of owning a home without the burden of a large upfront payment.